The Current Landscape of Thailand’s Wet Food Market

Thailand’s wet food market has demonstrated remarkable growth and resilience, shaping itself into a significant segment within the broader food industry. As of 2023, the market is valued at approximately 46 billion Baht, experiencing a compound annual growth rate (CAGR) that reflects evolving consumer habits and preferences. The surge in demand is primarily driven by an increasing number of urban households, changing lifestyles, and a growing inclination toward convenient food solutions. Wet food, characterized by its higher moisture content, caters well to consumers seeking freshness, taste, and nutrition, making it an attractive option for busy individuals and families.

Emerging trends within the wet food sector indicate a rising consumer awareness surrounding health and wellness, prompting a shift towards organic and natural ingredients. This inclination towards healthier options has encouraged manufacturers to innovate their products, aligning with market demand while also complying with regulatory standards aimed at food safety. Furthermore, the pandemic has notably accelerated changes in consumption patterns, with more consumers opting for home-cooked meals. This trend has provided substantial impetus for wet food products, as they offer convenience without compromising on taste or quality.

Statistics show that the popularity of wet food has increased significantly, with a reported growth in sales due to factors such as improved distribution channels, heightened marketing efforts, and the introduction of new product lines geared towards specific consumer segments. As retailers adapts their strategies to facilitate better access and visibility, the interaction between ODM orders and the wet food market has intensified, highlighting the importance of flexibility and innovation in meeting the dynamic demands of consumers. Understanding these aspects is crucial for stakeholders looking to make informed decisions within this vibrant market landscape.

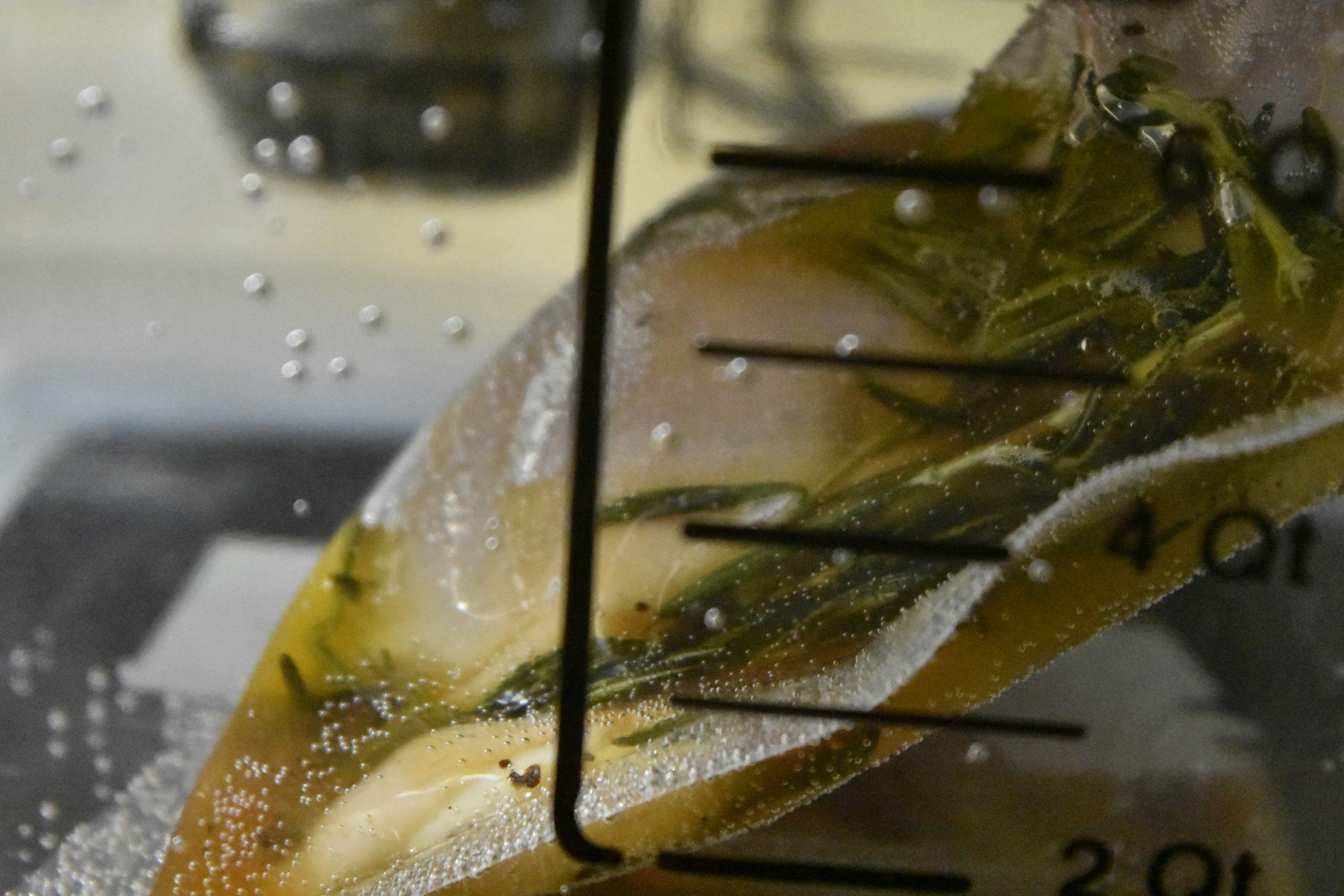

Understanding HPP Sterilization Technology

High Pressure Processing (HPP) is an innovative food preservation technology that employs high pressure to eliminate pathogens and spoilage organisms in various food products. By subjecting food to pressures typically ranging from 300 to 600 MPa, HPP effectively disrupts the cellular structures of harmful microorganisms while preserving the essential qualities of the food itself, such as flavor, nutritional value, and texture. This process differs significantly from traditional preservation methods, which primarily rely on heat, chemicals, or dehydration, which can often compromise the initial attributes of food.

One of the foremost advantages of HPP is its ability to maintain the nutritional integrity of wet food products. Through this non-thermal sterilization process, the vitamins, minerals, and antioxidants present in the food are largely retained — a stark contrast to conventional methods, which can lead to nutrient degradation. Furthermore, because HPP does not rely on heat, the flavors of the food remain intact, resulting in a high-quality end product that appeals to consumers.

The technology also plays a critical role in enhancing food safety. By effectively inactivating foodborne pathogens, HPP minimizes the risk of foodborne illnesses, a crucial consideration in the food industry. Its effectiveness has made HPP a preferred choice among Original Design Manufacturers (ODM) looking to produce high-quality wet food products tailored to consumer demands. Applications of HPP can be seen across diverse food segments, from ready-to-eat meals and sauces to fruit and vegetable juices, allowing each product to achieve extended shelf-life while ensuring food safety. Through its myriad applications, HPP sterilization technology is proving to be a significant driver in attracting ODM orders within the rapidly growing wet food market in Thailand.

The Rise of ODM Orders in Thailand’s Wet Food Sector

The surge in Original Design Manufacturer (ODM) orders in Thailand’s wet food sector can be attributed to several interrelated factors that reflect the market’s evolving dynamics. One of the primary drivers is the increasingly cooperative relationship between manufacturers and retailers. This collaboration has allowed manufacturers to better understand retailer needs and consumer preferences, leading to tailored product offerings that resonate well in the market. By leveraging ODM partnerships, manufacturers can align their production capabilities with the specific requirements of retailers, facilitating a smoother supply chain.

Customization stands out as a critical factor in the growth of ODM orders. Retailers and brands have begun to realize that generic products may not satisfy the diverse preferences of today’s consumers. Approximately 60% of consumers express a preference for unique flavors and variations, prompting companies to adopt ODM strategies to produce customized wet food products that cater to these preferences. The flexibility offered by ODM allows companies to experiment with novel recipes and packaging designs without bearing the full risk of product failure. This adaptability can lead to significant competitive advantages in a saturated market.

Moreover, the role of consumer preferences cannot be overstated. As more Thai consumers become health-conscious, they are increasingly seeking high-quality, nutritious wet food options. This shift in consumer demand has prompted manufacturers to adopt advanced technologies like High Pressure Processing (HPP) to enhance food safety and preserve freshness. Thus, ODM orders that incorporate such innovative techniques are emerging as a popular choice among retailers aiming to meet these heightened consumer expectations. Successful case studies demonstrate how companies harness ODM orders to launch niche products quickly, enabling them to capture market share while enhancing brand perception.

Future Outlook and Market Opportunities

As the demand for wet food continues to grow in Thailand, driven by changing consumer preferences and increased emphasis on convenience, the future outlook for the market appears promising. The integration of High-Pressure Processing (HPP) technology presents significant opportunities for Original Design Manufacturers (ODM) to expand their offerings and cater to emerging customer trends. HPP sterilization technology enhances product safety, quality, and shelf life, which are pivotal attributes for capturing consumer attention in this competitive landscape.

Anticipating market trends, we observe a notable shift towards healthier and more sustainable food options among Thai consumers. This inclination creates a fertile ground for innovative wet food products that prioritize nutritional value and environmentally friendly packaging. ODMs and manufacturers who embrace these trends and invest in HPP technology are well-positioned to meet the evolving demands of their clientele, thereby gaining a competitive edge.

However, the market is not devoid of challenges. One potential hurdle that could influence the wet food sector is regulatory changes related to food safety standards. Keeping abreast of these developments will be essential for ODMs to ensure compliance while maintaining product quality. Additionally, competition from alternative food sources, such as plant-based options, poses a threat that could impact traditional wet food sales. Hence, staying agile and adaptable is crucial for stakeholders looking to thrive in this dynamic environment.

Demographic shifts also play a vital role in shaping the wet food market. The increasing urbanization in Thailand, together with a growing affluent middle class, suggests a continual rise in demand for ready-to-eat meals. This demographic transition highlights the importance of accessible distribution channels and advanced production technologies. As market growth forecasts remain favorable, the adoption of HPP technology is expected to revolutionize the way wet food is produced, distributed, and consumed, paving the way for further investment and innovation in the sector.